WRC Retail Trends in ESG: Are you ready for CSRD?

The way retail companies disclose ESG issues in their financial reports is constantly evolving. Business leaders benefit from understanding these ESG trends when making important strategic business decisions.

Getting it right can mean engaging positively with all stakeholders, getting it wrong can mean accusations of greenwashing, reputational damage, or reduced investment options.

By looking at the ESG topics prioritized by companies in their financial reports, and the fastest-growing trends, it's clear that many retail businesses aren't yet ready for the new European Corporate Sustainability Reporting Disclosures (CSRD).

Global trends

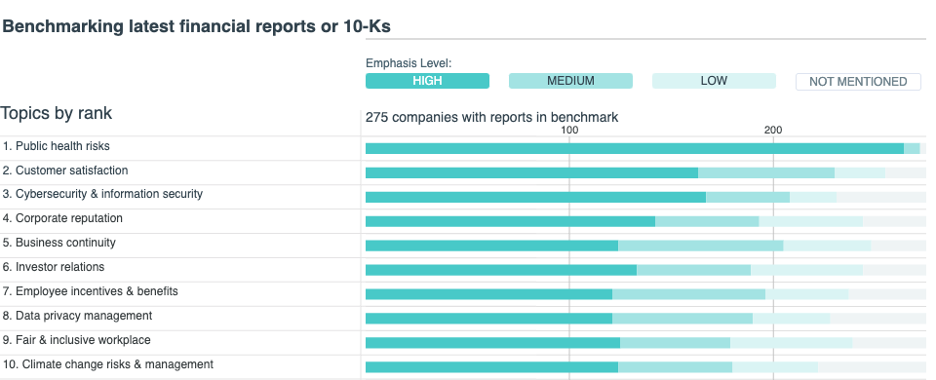

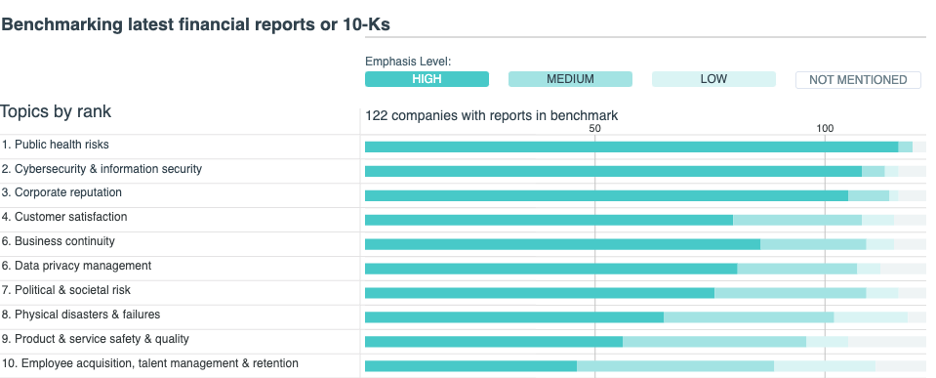

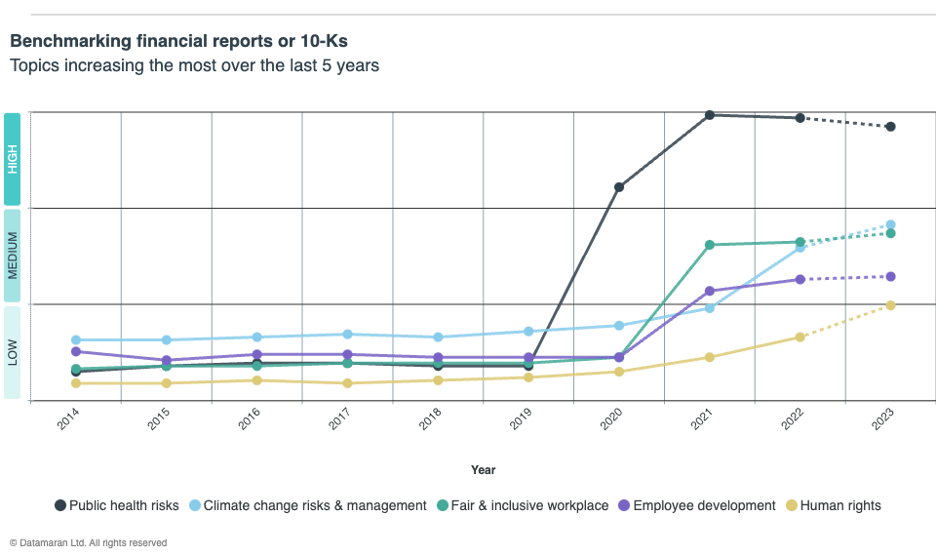

Public health risks dominate the global ESG landscape, not surprisingly given the Covid-19 pandemic, this pattern is reflected in the localized trends for The EU and the USA. The issue of public health risk remains high with only a slight drop since its peak in 2021.

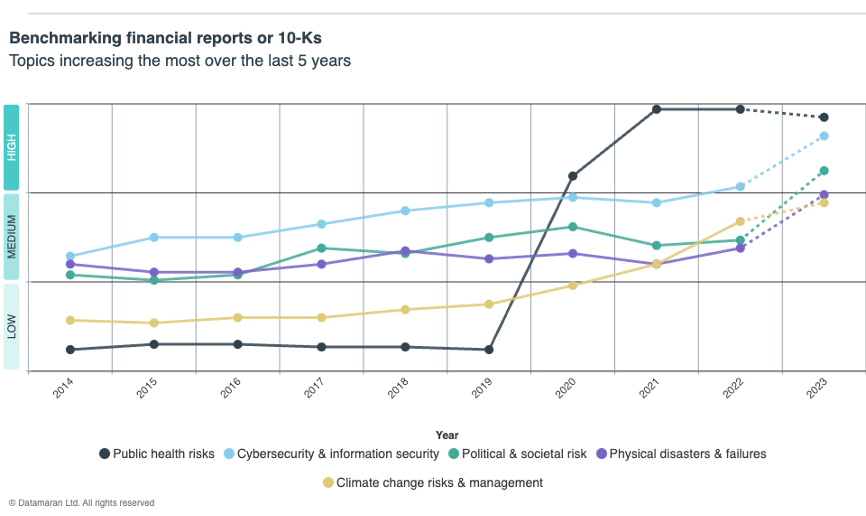

Cyber security and information security was the fastest-growing topic after Covid-19 pandemic, however, it has continued to rise steadily and could be the biggest concern for global retailers in 2023. Climate risk is also a key topic, however GHG emissions (17), energy use (28), and transition to renewable energy (31) rank relatively low. ESG governance structure (50) and non-financial reporting (57), some of the topics most relevant for CSRD, rank even lower.

Global Retail - Top 10 ESG issues

Global Retail - 10 fastest growing trends over the last five years

EU trends

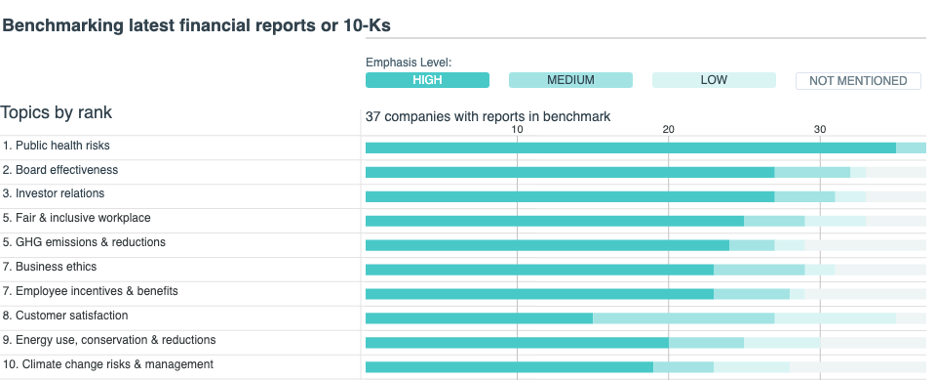

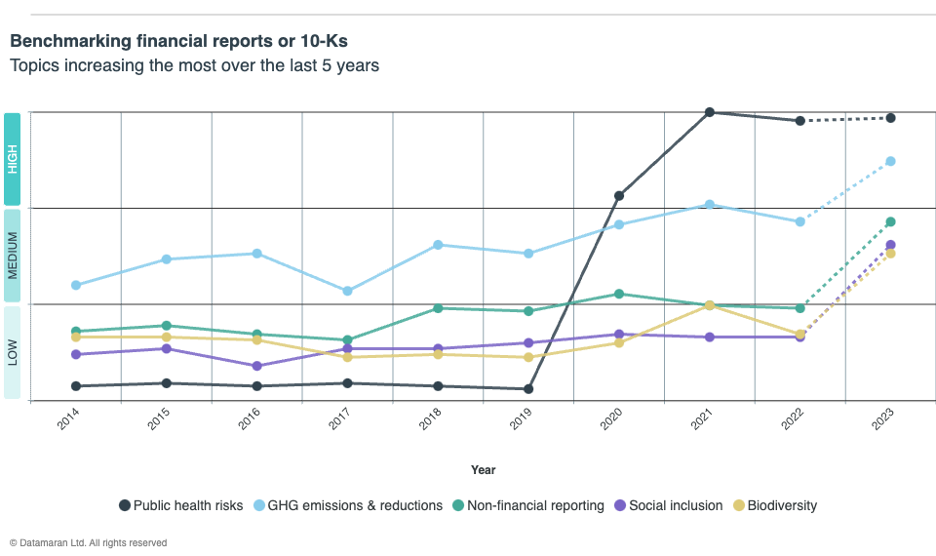

The EU has seen a significant rise in coverage of GHC emissions and reductions as well as non-financial reporting, with early signs of an increase in both in 2023. We expect the biggest driver of this trend is the CSRD, as EU regulations will soon require thousands of EU and non-EU companies to increase their sustainability reporting.

EU Retail - Top 10 ESG issues

EU Retail - Top 5 trends over the last five years

US trends

Despite being 11th and 13th in the top reported ESG issues, climate change risks, and fair and inclusive workplace practices were already the second and third fastest-growing trends for the US and that is likely to continue due to the wider global impact of CSRD. However, GHG emissions (28), non-financial reporting (67), and ESG governance structure (87) are extremely low on the US radar of US companies. This suggests a big shift in the coming months for qualifying companies to prepare for CSRD.

US Retail - Top 10 ESG issues

US Retail - 10 fastest growing trends over the last five years

CSRD

The implications of the CSRD on multinational corporations is far-reaching, and likely to result in ESG disclosure becoming a universally adopted practice. Developing internal systems and governance is a high priority for global retailers, so understanding the trends and how they are developing allows business decision-makers to focus resources on those areas and divert them from less important topics, reducing the financial impact, and increasing the strategic opportunity.

Data for this article was provided by Datamaran, the world's only data-driven platform to identify and monitor material ESG risks and opportunities.

)

)

)

)