Global Economic Outlook: Consumer Trends in a Time of Uncertainty

Gregory Daco, Chief Economist, EY

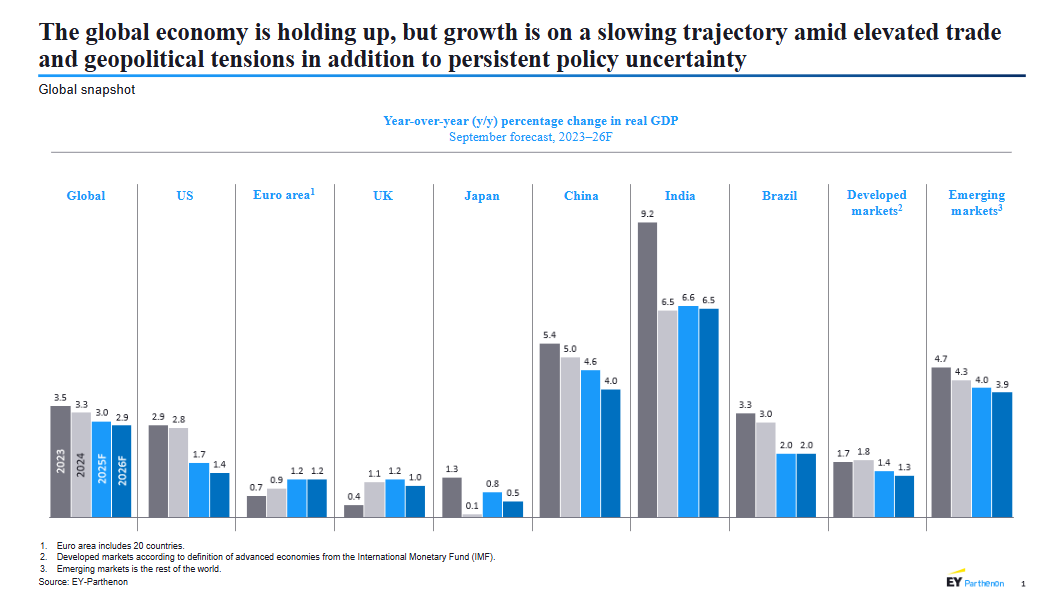

As we enter the final quarter of 2025, global consumers are navigating an environment shaped by resilience under pressure. Inflation has eased from its peaks in many advanced economies, yet core inflation remains persistent, and interest rates continue to exert a drag on economic activity. Tariffs, supply chain restructuring, and volatile energy prices further complicate the backdrop. In this context, global consumer spending is fragmenting – defined by sharper divergences across income groups and regions.

Consumer demand in some major advanced economies has remained more robust than expected, supported by solid household income and employment trends. However, this strength masks growing inequality. In the US, higher-income households continue to spend freely, particularly on services and durable goods. In contrast, lower-income households face increasing financial pressure from elevated borrowing costs and tighter access to credit. This divergence is fueling demand for value-oriented retailers and discount formats, while premium segments face marginally softer momentum. As the holiday season approaches, spending will persist but with more scrutiny. Promotions will be key to attracting cautious consumers.

Elsewhere, the recovery remains uneven. In parts of Europe, easing inflation and lower interest rates are starting to lift real incomes, yet high energy costs, weak industrial output, and constrained fiscal policy continue to weigh on growth. Consumer sentiment is fragile, with many households postponing large discretionary purchases. Tourism still provides some support, though its post-pandemic boost is fading. At the same time, fiscal consolidation and export weakness leave several economies vulnerable to stagnation, while rising populist tensions risk further undermining confidence and complicating policy responses.

In China, weak private investment, ongoing property market stress, and uncertain employment prospects are weighing on household confidence, prompting consumers to cut back on discretionary purchases. Spending is shifting toward essentials and lower-cost domestic brands, with growth opportunities increasingly concentrated in digital platforms and lower-tier cities. Elsewhere in Asia, momentum is firmer. Several markets are benefiting from solid domestic demand, a recovery in tourism, and resilient services activity. Improving real wages and favorable demographics are further bolstering consumption in many of these economies.

In Latin America, the outlook remains mixed. High borrowing costs, currency volatility, and fiscal constraints are straining household budgets in several economies, with lower-income consumers particularly exposed. At the same time, elevated political and populist tensions are adding to uncertainty, shaping expectations around fiscal and social policy. Yet there are pockets of resilience: countries with more stable inflation dynamics and credible policy frameworks are seeing consumer confidence improve, supporting gradual recoveries in discretionary spending. Real wage gains, a rebound in tourism, and ongoing expansion in digital commerce are also creating opportunities across the region, particularly in essentials and value-oriented retail formats.

Looking ahead to 2026, global consumer trends are expected to become more polarized. Higher-income groups are likely to sustain much of the discretionary spending, while lower-income households will remain focused on affordability. This will reinforce the ongoing shift toward discount, omnichannel, and value-based retail strategies. A broader trend for “conscious consumption” is taking hold. For many households, affordability remains the dominant priority in an environment of tighter budgets and elevated borrowing costs. Yet sustainability and transparency are becoming more influential in shaping brand loyalty and purchasing choices, particularly among younger and higher-income consumers.

Retailers and businesses must adapt swiftly. The next six to twelve months will reward those who can deliver personalized, digital-first experiences while offering clear value propositions. In a landscape shaped by economic fragmentation, the winners will be those who meet consumers where they are: discerning, digitally connected, and financially cautious.

)

)

)

)